This is a tough question as there is no 1 answer. The percentage of a portfolio that should be allocated to precious metals will vary depending on an investor’s individual circumstances, investment objectives, and risk tolerance. There is no one-size-fits-all answer to this question, and different financial experts and institutions may have different recommendations.

In general, it’s generally recommended that investors should allocate a small portion say 5% of their overall investment portfolio to precious metals. The precise percentage may vary depending on the investor’s risk tolerance, investment objectives, and other factors.

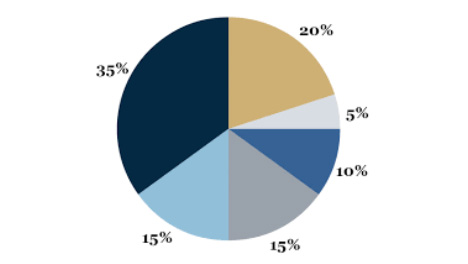

Some financial advisors may recommend allocating between 5% and 20% of a portfolio to precious metals. Others may suggest a smaller or larger allocation, depending on the investor’s individual situation. It really depends on the views and perceived outlook for the future of the financial markets and fiat currency in your country.

It’s important to note that investing in precious metals like investing in stocks or other financial instruments carries risks, and it may not be suitable for all investors. Before making any investment decisions, it’s important to carefully consider personal investment goals, risk tolerance, and other individual factors. It’s also recommended to seek the advice of a financial professional or do thorough research before making any investment decisions.

Some folks we know have 40% precious metals or bullion, 30% bonds, 20% equities and 10% cash. The answer is not 1 size fits all. It depends on you, your beliefs and your future plans.

Unlike a stock or some of histories worthless fiat currencies Gold, Silver and other precious metals have never gone to zero and for the most part have kept value in line with inflation.