Latest Articles

Need more information about the bullion market and alerts for latest rates? Follow our news articles.

BullionBankers Deep-Dive: 2025’s Historic Gold & Silver Rally and How Seasoned Stackers Are Cashing In

2025’s record gold and silver prices create a rare cash-out window. Explore proven selling tactics, tax angles, and trusted dealers read the www.BullionBankers.com guide now.

Read More...

Gold and Silver Surge 2026: Drivers, Bullion Flows, Price Targets

Expert trader view of the 2026 gold and silver rally, bullion market signals, key catalysts, risks, and why some banks see gold $6,000 and silver $150.

Read More...

Gold and Silver Surge Amid Global Economic Uncertainty

On May 20, 2024, gold surged to an all-time high of $2,438.50 per ounce and silver reached an 11-year high of $32.43. Discover why central banks are stockpiling precious metals amidst rising debt fears and high interest rates.

Read More...

Gold and Silver Surge 2026: Drivers, Bullion Flows, Price Targets

Expert trader view of the 2026 gold and silver rally, bullion market signals, key catalysts, risks, and why some banks see gold $6,000 and silver $150.

Read More...

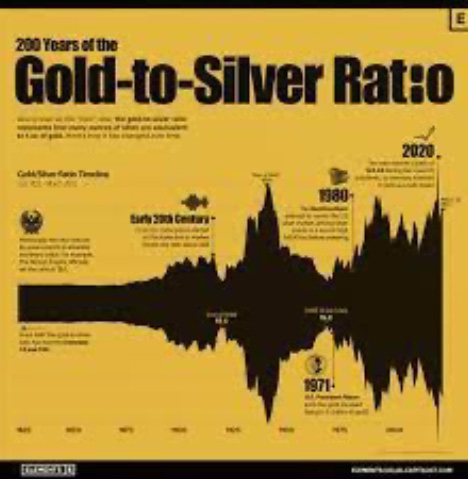

How much rarer is gold than silver?

Gold is estimated to be around 19 times rarer than silver due to its lower concentration in the Earth’s crust. However, factors such as supply and demand can influence their rarity. Silver is being increasingly used in commercial applications, and its demand may soon outpace supply.

Read More...

Gold and Silver Surge 2026: Drivers, Bullion Flows, Price Targets

Expert trader view of the 2026 gold and silver rally, bullion market signals, key catalysts, risks, and why some banks see gold $6,000 and silver $150.

Read More...

Gold Breaks $4,000, Silver Nears $50 Inside the 2025 Bullion Super-Rally

Discover what’s driving gold past $4,000 and silver toward $50 in the record 2025 bullion rally. Learn how central bank buying, U.S. debt, dollar weakness, and rate cuts fuel prices—and where to get a fair offer for your coins at CashForCoins.net.

Read More...

History of the us dollar coin

Explore the rich history of the US dollar coin, from silver and gold to the iconic Morgan and Peace dollars. Learn about the designs, key dates, and unique features of each coin in this comprehensive guide.

Read More...

Why was gold and silver the most common means of trade for 1000's of years?

Gold and silver have been used as currency for thousands of years due to their scarcity, uniformity, and durability. They are universally recognized and accepted and difficult to counterfeit, making them reliable stores of value.

Read More...