If the US dollar loses its status as the primary currency for oil transactions, it could have significant economic and geopolitical effects, including a decline in the demand for the dollar, a loss of US geopolitical influence, and greater complexity in the global oil market.

Read more...

Posted By: admin | May 8th, 2023

Learn about the petrodollar system and its impact on the global economy, US geopolitical influence, and oil markets. Discover the advantages and drawbacks of the petrodollar system, and the growing trend to remove or replace it.

Read more...

Posted By: admin | May 8th, 2023

Learn about the concept of a world reserve currency, its significance, and the factors that affect its lifespan. Discover how historical data shows that no currency has survived the test of time. Find out what a world reserve currency is and why it matters for global trade and financial transactions. Explore how the lifespan of a reserve currency is influenced by various economic and geopolitical factors.

Read more...

Posted By: admin | May 8th, 2023

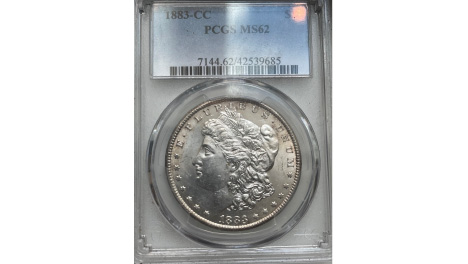

Learn why gold is recognized as a highly valuable asset for banks and financial institutions, and how it is viewed as a safe haven asset during times of economic uncertainty.

Read more...

Posted By: admin | May 8th, 2023

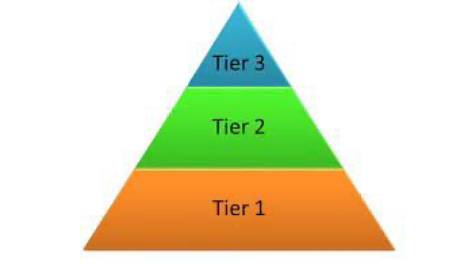

Learn about the highest quality and most liquid assets known as Tier 1 assets, including cash, sovereign bonds, and gold. Discover why gold is considered the only Tier 1 asset with no counterparty risk and how it can help manage risk in portfolios.

Read more...

Posted By: admin | May 8th, 2023

What would happen if the US dollar is no longer the world’s primary reserve currency? This article explores the economic and financial implications for the United States and the global economy.

Read more...

Posted By: admin | May 8th, 2023

Learn about hyperinflation, its definition, recent examples, and the social and economic consequences it brings. Discover why some people hold precious metals as assets to protect their wealth during hyperinflationary scenarios.

Read more...

Posted By: admin | May 8th, 2023

China’s gold reserves have not been updated since 2016, leading to speculation on the accuracy of their reported figures. Some experts suggest that China may hold more gold than what is officially reported. However, without concrete data, it is difficult to estimate the actual size of China’s gold reserves or to compare it with other countries like the United States.

Read more...

Posted By: admin | May 8th, 2023

Read about the reasons behind the surge in gold prices during the deflationary period after the Great Depression. Learn about factors such as loss of confidence in the US dollar, government policies, and geopolitical uncertainty that led investors to seek the safe haven of gold.

Read more...

Posted By: admin | May 8th, 2023

Learn about the Bland-Allison Act and the Sherman Silver Purchase Act, two United States federal laws that aimed to stabilize the economy by increasing the money supply and promoting inflation, but ultimately failed to achieve their goals.

Read more...

Posted By: admin | May 8th, 2023