Like platinum, palladium is a precious metal that has seen significant fluctuations in price throughout its history. Here are some key events and their impact on palladium prices:

- 1800s-1900s: Palladium was discovered in 1803 and was initially considered a rare and valuable metal, with prices generally higher than those of gold and silver.

- Mid-20th century: The use of palladium in catalytic converters and other automotive applications began to increase, leading to a surge in demand and prices.

- 1970s-1980s: With the introduction of stricter emissions regulations, the demand for palladium in catalytic converters skyrocketed, leading to prices that briefly surpassed those of gold.

- 1990s-present: Like other precious metals, palladium prices have been influenced by a wide range of economic and political factors, as well as supply and demand dynamics. In recent years, prices have been particularly volatile due to concerns over geopolitical tensions, trade disputes, and supply disruptions.

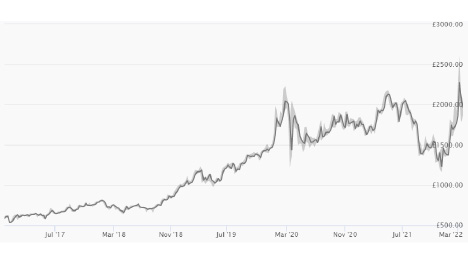

In early 2020, palladium prices hit an all-time high above $2,800 per ounce, driven in part by increased demand from automakers and limited supply from major producers such as Russia and South Africa. Since then, prices have pulled back somewhat but remain historically elevated. As with any investment, it’s important to carefully consider all relevant factors and seek professional advice before making any decisions.

In the bullion world Palladium is not as common a participant as gold and silver. It’s more like Platinum thus there are far fewer options other than bars and a few different coins or rounds.

Click here for realtime palladium prices