It is possible that the world could move back towards a currency backed by precious metals, although such a shift would require significant changes in the global monetary system and international cooperation among governments and central banks. There has been a lot of discussion recently about Russia China and other BRICS nations of creating precious metals backed currency to compete with the dollar.

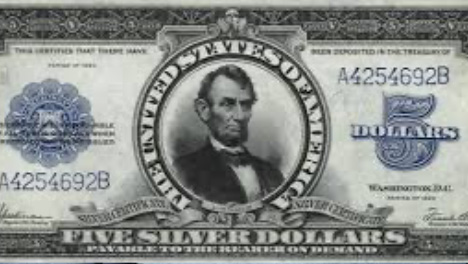

In the past, many currencies were backed by gold or silver, with the value of the currency tied to a specific quantity of the precious metal. This was known as the gold standard or the silver standard, depending on the metal used. However, over time, most countries moved away from the gold standard and adopted fiat currencies that are not backed by a specific commodity. Some argue this allowed for the accumulation of massive debt by so many countries as it was no longer tied to precious metals.

There have been occasional calls for a return to the gold standard, particularly during times of economic uncertainty or instability. Proponents argue that a gold-backed currency would provide greater stability and reduce the risk of inflation, as the money supply would be tied to the availability of gold. However, critics argue that a return to the gold standard could limit the ability of governments and central banks to respond to economic downturns and could lead to deflationary pressures. Is there even enough gold & silver???

Overall, it is difficult to predict whether or not the world will move back towards a currency backed by precious metals, as such a shift would require significant changes to the global monetary system and the agreement and cooperation of multiple governments and central banks. All we know as of right now is that there are some major players considering it.