Gold and Silver Surge 2026: Drivers, Bullion Flows, Price Targets

Expert trader view of the 2026 gold and silver rally, bullion market signals, key catalysts, risks, and why some banks see gold $6,000 and silver $150.

Why Silver Is Set Up for a Major Move Higher: A Bullion Dealer’s Deep Dive

For years, silver has been one of the most misunderstood assets in the financial markets. It’s dismissed as volatile, manipulated, or “too industrial” to be monetary— yet simultaneously too monetary to be treated like a base metal.

Why Your Precious Metals Allocation Is Too Low Insights from Ray Dalio’s 1970s Warning

Ray Dalio warns today’s financial landscape mirrors the early 1970s and suggests holding 15% in gold. Learn why most portfolios underweight precious metals and how to rebalance meaningfully for defense and upside.

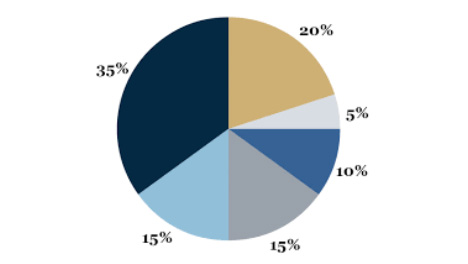

What share of a portfolio should be in precious metals?

Learn how much of your investment portfolio should be allocated to precious metals. Investing in precious metals carries risks and requires careful consideration of personal goals and risk tolerance. Seek professional advice and do thorough research before making any investment decisions.

Who should not buy precious metals

Precious metals may not be the best investment option for everyone. Factors such as short-term investment goals, low risk tolerance, limited funds, lack of understanding, and need for income can make investing in precious metals challenging. Read on to learn more about why someone may not want to invest in precious metals.

Difference between numismatic coins and bullion

Learn about the differences between numismatic coins and bullion coins and their purposes. Investing in numismatic coins for historical and artistic value. Investing in numismatic coins for historical and artistic value.

Is there any counter party risk in owning physical precious metals?

Learn about how owning physical precious metals can help mitigate counterparty risk and the potential risks involved in trading in precious metals.

What impacts the value of precious metals?

Learn about the various factors that can affect the value of precious metals like gold, silver, and platinum, including supply and demand, economic and political uncertainty, inflation, interest rates, industrial demand, currency exchange rates, global events, technological advancements, production costs, central bank policy, seasonal demand, and market sentiment.

Precious metals performance during inflationary periods

Learn how gold and silver act as safe-haven assets during periods of high inflation, preserving purchasing power and providing a hedge against currency devaluation. Discover how the relationship between inflation and precious metal prices can be influenced by various factors, such as supply and demand, geopolitical events, and investor sentiment. Find out how silver has maintained or surpassed the value of currency over time, offering a near double inflation adjusted return and an 8.5X full return.

How to choose between buying gold or silver

Choosing between buying gold or silver depends on various factors such as historical performance, volatility, affordability, purpose of investment, personal beliefs. This article outlines the key factors to help you make an informed decision.