Platinum is another precious metal that has seen significant fluctuations in price throughout history. Here are some key events and their impact on platinum prices:

- 18th and 19th centuries: Platinum was relatively unknown and undervalued, with prices often lower than gold and silver even though it significantly rarer than both of them.

- Late 19th and early 20th centuries: With the development of new technologies and industries, such as the automobile and chemical sectors, demand for platinum began to rise, leading to price increases. Platinum was primarily used in the catalytic converter.

- 1920s-1930s: The Soviet Union began to dominate platinum production, leading to a decline in prices due to oversupply.

- 1940s-1950s: The use of platinum in catalytic converters and other automotive applications led to a significant increase in demand and prices.

- 1970s-1980s: South Africa, the largest producer of platinum, faced political instability and labor unrest, leading to supply disruptions and price spikes.

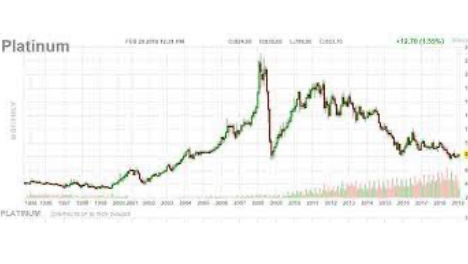

- 1990s-present: Platinum prices have remained relatively volatile, driven by fluctuations in global demand and supply, as well as broader economic and political factors.

In recent years, platinum prices have been significantly lower than those of gold and silver, due in part to concerns over global economic growth and the declining demand for diesel engines (which are a major use case for platinum). However, some analysts believe that platinum could see a rebound in prices in the coming years, particularly if demand for electric vehicles (which require significant amounts of platinum for their batteries) continues to grow. As with any investment, it’s important to carefully consider all relevant factors and seek professional advice before making any decisions. The switch from platinum to palladium in the automotive industry was one of the factors that contributed to changes in the prices of these metals. Not that Platinum is about half the price of palladium some feel the industry may switch back to platinum.

Here is a clear case when rarity doesn’t equal higher price as platinum production is roughly 3% of gold production yet its cost is about half the price.