The premiums for junk silver can be relatively high compared to other forms of silver bullion, for a few different reasons:

- High Demand: Junk silver is a popular form of investment because it allows investors to own small denominations of silver, making it more affordable and easier to trade. This high demand can drive up the premiums.

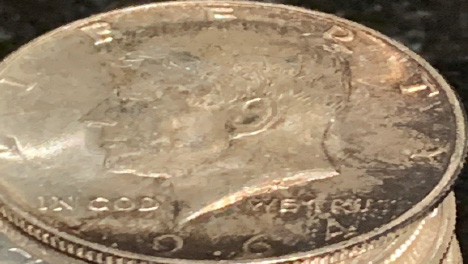

- Limited Supply: Junk silver coins were minted before 1965 and are no longer in production, which means the supply is limited and cannot be increased. This scarcity can also drive up the premiums. During many previous run ups in silver prices a huge amount of junk silver has been melted down and processed by refineries thereby reducing the overall population of these coins.

- Processing Costs: Because junk silver coins are often heavily worn and damaged, they need to be sorted and processed before they can be sold as bullion. This processing can be expensive, which is reflected in the premium.

- Numismatic Value: While junk silver coins have little to no numismatic value, some coins may be in better condition than others, which can affect their value. Coins in better condition may command a higher premium. Lots of people buy in bulk and then sift through sorting out the better condition coins or better dates/mints.

- Market Conditions: Like any investment, the price of junk silver is also influenced by market conditions, including supply and demand, the price of silver, and other economic factors. This can cause the premiums to fluctuate over time.

- Government Made: its common for government issues bullion to trade at a higher premium than private mints to its legitimacy and universal acceptance.

Overall, the premiums for junk silver reflect the costs involved in obtaining, processing, and selling these coins as bullion, as well as the market conditions and investor demand for this type of investment. Junk silver will likely remain as a premium bullion product for generations.